[

{

"name": "500x250 Ad",

"insertPoint": "5",

"component": "15667920",

"parentWrapperClass": "",

"requiredCountToDisplay": "1"

}

]

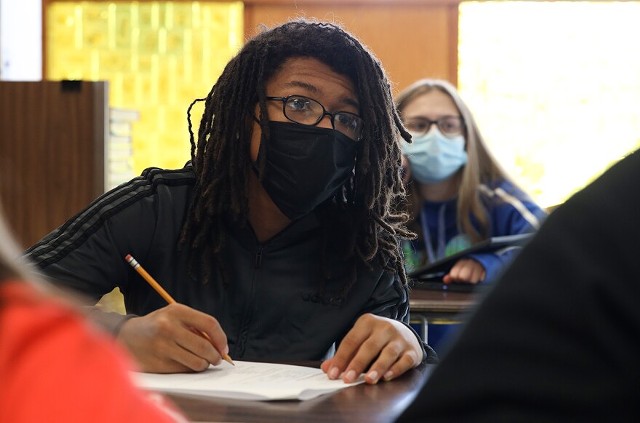

About 15 kids are in Daile Cox’s fifth-period math class at Rochester’s School of the Arts. The students are getting settled, logging into their laptops, Chromebooks or tablets before they begin a fierce battle: Who knows the most math terms?

Cox eggs on the class to compete as the students joust their way through a 20-question quiz. But this math class is a little different from most: The assignment is peppered with answers they learned from discussions on everyday activities like car buying.

Afterward, Tenia Mitchell Lawrence, a 16-year-old junior, described how the class used YouTube tutorials and sites like Kelly Blue Book to learn how to compare car prices.

“I like what we’re learning,” Mitchell Lawrence said. “Like we’re learning math, but it’s about financial stuff that we’ll need in the real world.”

That was also the appeal for Rosabella Rodiguez, a 17-year-old senior who hopes to study zoology in college next fall.

“It's not that I hate math,” Rodiguez said. “Just it's not my biggest thing and it's not something I'm trying to go into in the future. So, I didn't want to take the other math courses, and I knew this would be a class that would help me financially in the future.”

The class is covering credit scores, how to do taxes, what to expect from a paycheck and even how much apartments cost — the kinds of things most people don’t learn until they’re forced to as adults.

But more and more school districts are introducing these ideas in high school. And there’s even talk of making it a statewide requirement.

At Hilton High, Theresa Jasen asked her business students to track their expenses for a month and share it with the rest of the class. It was an eye-opening experience for 17-year-old Trevor Burkis.

To be fair, Burkis isn’t your typical teen. His parents set up a Roth IRA for him, and he contributes between $50 and $100 of the salary he earns as a pet store cashier to the account each week. After going through the exercise, he realized his approach to money is very different from his classmates.

“I saw that some people spend a lot of their money. People would get paid $200 and spend $190 of it,” Burkis said. “We figured out what expenses were necessary, and what was not and how to prioritize our money to set up us for a successful future.”

This is the second financial literacy course that his classmate Korey Lombard has taken. Before the classes, the 15-year-old said she didn’t know much about the topic. Her interest was piqued by watching her parents do taxes and wrestle with bills.

“I knew like the basic stuff going in, like don’t spend a lot of money,” Lombard said. “But now I know about different taxes and bank account names and different jobs and all of this. It really helps for the future.”

Sentiments like that are no surprise to Kevin Meuwissen, who taught high school social studies before becoming the chair of the teaching and curriculum program at the University of Rochester’s Warner School of Education.

“The demand for this kind of work is in part coming from kids saying, ‘I don't understand the sort of fiscal environment in which I'm entering,’” Meuwissen said.

Now 20 months into the COVID-19 pandemic, the economic environment is very different than it once was. Bureau of Labor Statistics data from 2020 shows that one in four households in the country had trouble paying bills during the COVID-19 pandemic. In that same time, unemployment rates reached levels that haven’t been seen in decades. That has rebounded for the most part, but a large chunk of the labor force has not returned to work.

With worries about things like inflation, food prices, mounting bills and job insecurity, there is a lot of cultural and financial angst at the moment, and Meuwissen said the kids notice that.

“They feel underprepared,” he said. “They feel like there’s a lot of things going on around them that have personal financial implications and they don’t know how to make sense of them.”

The idea of financial literacy classes for teens is not new. In New York state, various lawmakers have pushed for them since at least 2015, but there has been a national groundswell of movement on the issue in 2021. About half of the country’s state legislatures have introduced variations of measures mandating financial literacy courses be taught in high schools. They quickly became law in just under a dozen of them, including Arkansas, Colorado, Rhode Island, Ohio, and Texas.

In New York state, the latest version is from two Monroe County lawmakers, Republican Assemblymemember Josh Jensen of Greece, and Democratic state Sen. Jeremy Cooney of Rochester. Cooney, a Rochester City School District graduate, argues that that requiring this kind of coursework is overdue.

“We have done a disservice to generations of students who don’t have that financial wherewithal to prepare themselves to be successful, whether they’re entering the armed forces, or going into a two-or four-year college or starting their own business,” Cooney said.

He said in many underserved communities, there are no banks.

“(They) may only have a check-cashing location that there are predatory practices that take advantage of that lack of information,” Cooney said.

After speaking with business leaders and financial experts, Jensen wrote the bill for many of the same reasons. The 32-year-old lawmaker said his generation is struggling with their finances.

“What I've seen both, while being in elected office, whether at the town level, at the state level, even prior, was that my colleagues in the world, people I graduated with and younger, have been struggling with the financial decisions that they have to make as adults,” Jensen said. “When I look at the school system, I think New York state needs to do a better job of preparing students for the life skills that they're going to need after graduation as functioning adults in society.”

Like most legislation of this kind across the country, the Jensen/Cooney bill would leave the how and what to teach for the state education department, school districts, and teachers to figure out.

The legislators are seeking co-sponsors to try to build momentum to make the bill reality.

While the state education department does not comment on pending legislation, officials there agree with the lawmakers for the most part. In a statement, they call financial literacy skills “an important example of the civic readiness skills necessary for students to attend to their own needs, enabling them to become positive agents of change.”

Rochester’s state Regents, Wade Norwood and Ruth Turner, are leading a hearing on the topic in December. They also expect financial literacy to be discussed as a new blue-ribbon commission on the future of New York’s curriculum takes off in the coming months.

While Meuwissen likes the idea in macro, he said there is only anecdotal proof that these courses make a long-term impact on students’ lives. He’s also concerned about its implementation. There is a finite amount of time and resources that can be applied to every element of a school day, he said, and how resources are divided has caused tension “persistent since the dawn of public education.”

Jensen would prefer a standalone course; he said the bill is flexible enough to allow schools to incorporate it in pre-existing coursework to avoid new costs.

Another issue is figuring out how financial literacy should be taught, and Meuwissen said there’s even less information on that.

“There’s no consensus among teachers necessarily, there’s no consensus among school districts, there’s no consensus among lawmakers necessarily or even among people who study how these things manifest in schools,” he said.

Those differences are playing out in Monroe County. At School of the Arts, Dale Cox uses financial literacy to teach his students about math. On the day we visited, in the game showing who knew the most math terms, he used grocery shopping as an example to explain outliers.

The idea is to show students how they could use math concepts outside classrooms.

“The foundation of the course is mathematics,” Cox said. “But I’m doing it in a different kind of way, a real-life way. So, it makes the math understandable for the students.”

At Hilton High, Theresa Jasen walked her students through her own debt and how to take out a home equity loan. Jasen said she’s showing students what they could face when they’re older, and what might be going on at home now.

“I think it's so necessary, and so helpful and so important to see what mom and dad are doing,” Jasen said.

James Brown is a reporter for WXXI News, a media partner of CITY.

Cox eggs on the class to compete as the students joust their way through a 20-question quiz. But this math class is a little different from most: The assignment is peppered with answers they learned from discussions on everyday activities like car buying.

Afterward, Tenia Mitchell Lawrence, a 16-year-old junior, described how the class used YouTube tutorials and sites like Kelly Blue Book to learn how to compare car prices.

“I like what we’re learning,” Mitchell Lawrence said. “Like we’re learning math, but it’s about financial stuff that we’ll need in the real world.”

That was also the appeal for Rosabella Rodiguez, a 17-year-old senior who hopes to study zoology in college next fall.

“It's not that I hate math,” Rodiguez said. “Just it's not my biggest thing and it's not something I'm trying to go into in the future. So, I didn't want to take the other math courses, and I knew this would be a class that would help me financially in the future.”

The class is covering credit scores, how to do taxes, what to expect from a paycheck and even how much apartments cost — the kinds of things most people don’t learn until they’re forced to as adults.

But more and more school districts are introducing these ideas in high school. And there’s even talk of making it a statewide requirement.

At Hilton High, Theresa Jasen asked her business students to track their expenses for a month and share it with the rest of the class. It was an eye-opening experience for 17-year-old Trevor Burkis.

To be fair, Burkis isn’t your typical teen. His parents set up a Roth IRA for him, and he contributes between $50 and $100 of the salary he earns as a pet store cashier to the account each week. After going through the exercise, he realized his approach to money is very different from his classmates.

“I saw that some people spend a lot of their money. People would get paid $200 and spend $190 of it,” Burkis said. “We figured out what expenses were necessary, and what was not and how to prioritize our money to set up us for a successful future.”

This is the second financial literacy course that his classmate Korey Lombard has taken. Before the classes, the 15-year-old said she didn’t know much about the topic. Her interest was piqued by watching her parents do taxes and wrestle with bills.

“I knew like the basic stuff going in, like don’t spend a lot of money,” Lombard said. “But now I know about different taxes and bank account names and different jobs and all of this. It really helps for the future.”

Sentiments like that are no surprise to Kevin Meuwissen, who taught high school social studies before becoming the chair of the teaching and curriculum program at the University of Rochester’s Warner School of Education.

“The demand for this kind of work is in part coming from kids saying, ‘I don't understand the sort of fiscal environment in which I'm entering,’” Meuwissen said.

Now 20 months into the COVID-19 pandemic, the economic environment is very different than it once was. Bureau of Labor Statistics data from 2020 shows that one in four households in the country had trouble paying bills during the COVID-19 pandemic. In that same time, unemployment rates reached levels that haven’t been seen in decades. That has rebounded for the most part, but a large chunk of the labor force has not returned to work.

With worries about things like inflation, food prices, mounting bills and job insecurity, there is a lot of cultural and financial angst at the moment, and Meuwissen said the kids notice that.

“They feel underprepared,” he said. “They feel like there’s a lot of things going on around them that have personal financial implications and they don’t know how to make sense of them.”

The idea of financial literacy classes for teens is not new. In New York state, various lawmakers have pushed for them since at least 2015, but there has been a national groundswell of movement on the issue in 2021. About half of the country’s state legislatures have introduced variations of measures mandating financial literacy courses be taught in high schools. They quickly became law in just under a dozen of them, including Arkansas, Colorado, Rhode Island, Ohio, and Texas.

In New York state, the latest version is from two Monroe County lawmakers, Republican Assemblymemember Josh Jensen of Greece, and Democratic state Sen. Jeremy Cooney of Rochester. Cooney, a Rochester City School District graduate, argues that that requiring this kind of coursework is overdue.

“We have done a disservice to generations of students who don’t have that financial wherewithal to prepare themselves to be successful, whether they’re entering the armed forces, or going into a two-or four-year college or starting their own business,” Cooney said.

He said in many underserved communities, there are no banks.

“(They) may only have a check-cashing location that there are predatory practices that take advantage of that lack of information,” Cooney said.

After speaking with business leaders and financial experts, Jensen wrote the bill for many of the same reasons. The 32-year-old lawmaker said his generation is struggling with their finances.

“What I've seen both, while being in elected office, whether at the town level, at the state level, even prior, was that my colleagues in the world, people I graduated with and younger, have been struggling with the financial decisions that they have to make as adults,” Jensen said. “When I look at the school system, I think New York state needs to do a better job of preparing students for the life skills that they're going to need after graduation as functioning adults in society.”

Like most legislation of this kind across the country, the Jensen/Cooney bill would leave the how and what to teach for the state education department, school districts, and teachers to figure out.

The legislators are seeking co-sponsors to try to build momentum to make the bill reality.

While the state education department does not comment on pending legislation, officials there agree with the lawmakers for the most part. In a statement, they call financial literacy skills “an important example of the civic readiness skills necessary for students to attend to their own needs, enabling them to become positive agents of change.”

Rochester’s state Regents, Wade Norwood and Ruth Turner, are leading a hearing on the topic in December. They also expect financial literacy to be discussed as a new blue-ribbon commission on the future of New York’s curriculum takes off in the coming months.

While Meuwissen likes the idea in macro, he said there is only anecdotal proof that these courses make a long-term impact on students’ lives. He’s also concerned about its implementation. There is a finite amount of time and resources that can be applied to every element of a school day, he said, and how resources are divided has caused tension “persistent since the dawn of public education.”

Jensen would prefer a standalone course; he said the bill is flexible enough to allow schools to incorporate it in pre-existing coursework to avoid new costs.

Another issue is figuring out how financial literacy should be taught, and Meuwissen said there’s even less information on that.

“There’s no consensus among teachers necessarily, there’s no consensus among school districts, there’s no consensus among lawmakers necessarily or even among people who study how these things manifest in schools,” he said.

Those differences are playing out in Monroe County. At School of the Arts, Dale Cox uses financial literacy to teach his students about math. On the day we visited, in the game showing who knew the most math terms, he used grocery shopping as an example to explain outliers.

The idea is to show students how they could use math concepts outside classrooms.

“The foundation of the course is mathematics,” Cox said. “But I’m doing it in a different kind of way, a real-life way. So, it makes the math understandable for the students.”

At Hilton High, Theresa Jasen walked her students through her own debt and how to take out a home equity loan. Jasen said she’s showing students what they could face when they’re older, and what might be going on at home now.

“I think it's so necessary, and so helpful and so important to see what mom and dad are doing,” Jasen said.

James Brown is a reporter for WXXI News, a media partner of CITY.